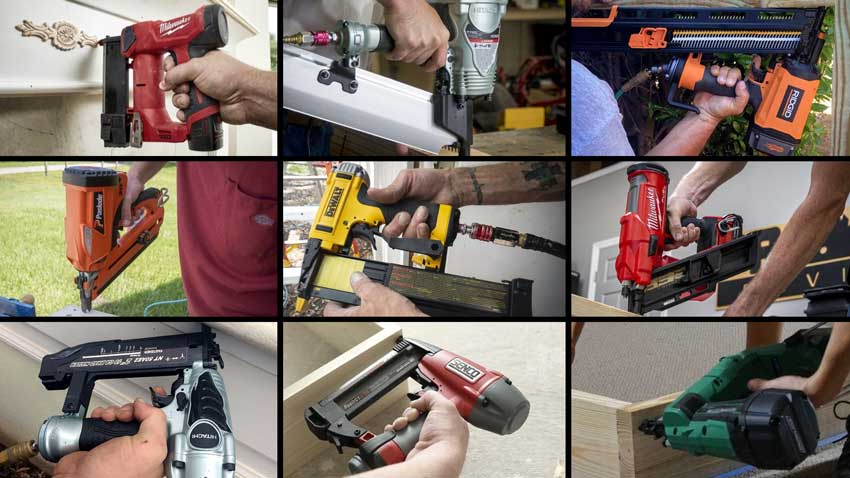

Pneumatic Precision: The Art and Science of Nail Guns delves into the fascinating world of nail guns, exploring the intricate balance between artistry and engineering that defines these indispensable tools. At the core of this comprehensive guide is the pneumatic technology that propels these devices into the realm of precision and efficiency. The seamless orchestration of air pressure, mechanics, and design transforms the seemingly simple act of driving a nail into a symphony of craftsmanship. As readers navigate through the pages, they will gain a profound understanding of the various components that contribute to the nail gun’s effectiveness. The artistry of nail guns lies not only in their functional design but also in their ergonomic considerations. This title explores the ergonomic intricacies that make these tools comfortable and intuitive to use, allowing craftsmen to channel their skills seamlessly. From the grip to the trigger mechanism, every aspect is a carefully curated element designed to enhance the user experience.

Applications and Uses of Nail Guns

The book unveils the thought processes behind these ergonomic choices, shedding light on the symbiotic relationship between the craftsman and the tool that defines a successful project. Moreover, the science behind nail guns takes center stage, revealing the meticulous engineering required to transform pressurized air into a controlled force for precision fastening. The book covers the anatomy of nail guns, dissecting the intricate Best Nail Gun components responsible for driving nails with unparalleled accuracy. From the magazine that houses the nails to the firing pin that releases them, each element is meticulously examined, providing readers with a comprehensive understanding of the inner workings of these devices.

Examine the Workings of Nail Guns

Beyond the basic mechanics, Pneumatic Precision also delves into the evolution of nail gun technology. Readers will embark on a journey through the history of these tools, witnessing the transformative innovations that have shaped their contemporary form. From the earliest pneumatically powered nail guns to the cutting-edge models of today, the narrative captures the relentless pursuit of excellence that defines the industry. In conclusion, Pneumatic Precision: The Art and Science of Nail Guns offer enthusiasts, craftsmen, and professionals alike an immersive exploration of a tool that has revolutionized the construction and carpentry landscape. The book seamlessly weaves together the artistic considerations of ergonomic design with the scientific intricacies of pneumatic technology, providing a holistic perspective on the nail gun’s role in modern craftsmanship. Whether you are a seasoned professional or an aspiring DIY enthusiast, this guide is a compelling resource that demystifies the complexities behind the seemingly simple act of driving a nail.

Beyond the basic mechanics, Pneumatic Precision also delves into the evolution of nail gun technology. Readers will embark on a journey through the history of these tools, witnessing the transformative innovations that have shaped their contemporary form. From the earliest pneumatically powered nail guns to the cutting-edge models of today, the narrative captures the relentless pursuit of excellence that defines the industry. In conclusion, Pneumatic Precision: The Art and Science of Nail Guns offer enthusiasts, craftsmen, and professionals alike an immersive exploration of a tool that has revolutionized the construction and carpentry landscape. The book seamlessly weaves together the artistic considerations of ergonomic design with the scientific intricacies of pneumatic technology, providing a holistic perspective on the nail gun’s role in modern craftsmanship. Whether you are a seasoned professional or an aspiring DIY enthusiast, this guide is a compelling resource that demystifies the complexities behind the seemingly simple act of driving a nail.